Development Bank Ghana officially begins operation

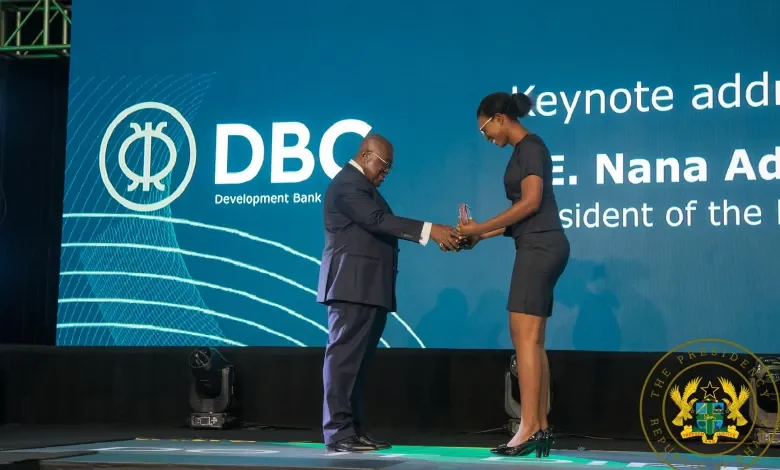

The Development Bank Ghana (DBG) has officially begun operations following its official launch by President Akufo-Addo on Tuesday.

The Bank of Ghana (BoG) in November last year granted a licence to the government to establish the bank that will focus predominantly on economic transformation, in particular industrialisation and value-addition in agriculture.

It will also focus on SMEs and relatively large Ghanaian corporates in these sectors to help transform the economy and create jobs.

Speaking at the official launch of the Development Bank Ghana in Accra on Tuesday (14 June), Ofori-Atta charged the financial outfit to manage its affairs prudently.

“DBG is designed to be financially sustainable,” he said.

“Total available resources for the bank both equity and debt is currently about US$750 million. Our equity commitment is US$250 million out of which US$200 million has been paid, while the German Government through Kfw has given DBG a subordinated debt of 46.5m Euros and an additional three million Euros grant for technical assistance. The World Bank and EIB have given the bank US$225 million and 170m Euros respectively. AfDB have also given the government US$40 million grant which has been given to the bank as equity,” the Finance Minister said.

“It is our firm expectation DBG will manage it affairs prudently, that soon it will be able to go to the market, both domestic and international, to raise its own funds on the basis of its balance sheet. This therefore requires the Board and Management to work hard toward getting an international rating for the Bank within the shortest possible time,” he said.

The DBG is expected to source funds on the domestic, regional and international capital markets by issuing bonds and diaspora instruments and by borrowing directly periodically.

The DBG is being positioned as a post-COVID-19 recovery institution, learning from the experience of institutions such as KfW in Germany and the Development Bank of Singapore, which played a critical role in transforming the economies of their home countries.