Nigeria Decides 2023: back to business as usual?

What are the implications for markets in Nigeria and beyond of the 2023 general election?

The presidential race in Nigeria has been adjudged the most keenly contested election in the nation’s political history, spotlighting divisions along ethnic, regional and religious lines.

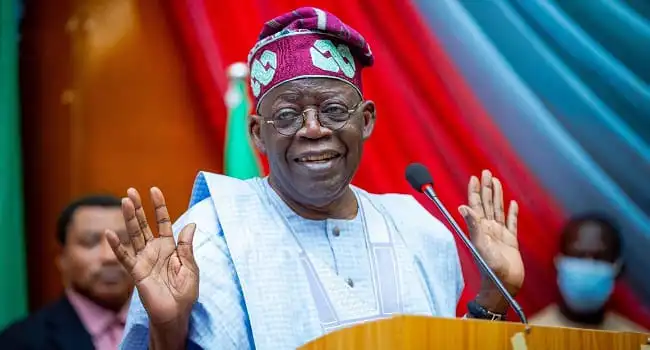

There were 18 presidential candidates. However, the contest was between three political heavyweights: Bola Ahmed Tinubu of the All Progressives Congress (APC), Atiku Abubakar of the Peoples Democratic Party (PDP) and Peter Obi of the Labour Party (LP) who, for the first time in the history of modern Nigeria, offered a credible third-force candidate.

The election took place against a backdrop of elevated security challenges, unpopular exchange-rate policies and inadequate structural reforms.

The winner will be tasked with making a course correction anchored on economic policy. Moreover, fiscal and structural reforms as a continuation of the current trajectory will probably derail medium-term budgetary and external sustainability and further aggravate macroeconomic imbalances.

Getting out of reverse gear

The Labour Party’s Peter Obi made a strong showing, reflecting pre-election opinion polls that made him the favourite to win.

The mood in favour of change was reinforced by widespread economic hardship, with headline inflation remaining high and continued difficulties created by petrol scarcity and the scorching effect of the recent naira redesign policy.

However, in the final analysis, the regional demographic negated this scenario. The large population in northern Nigeria (about 54% of the country’s total registered voters are from the north) seems to have skewed the election outcome, leading to increased uncertainty and political tension, which could affect the markets.

According to the International Monetary Fund, Nigeria’s revenue was 7.1% of gross domestic product (2021), lower than the average for 31 other African countries. Revenues for 2022 were affected by dwindling oil revenue, caused by much lower oil production, low tax revenues and non-diversification of the revenue base.

The World Bank estimates that Nigeria could have generated ₦6 trillion in VAT revenues in 2020 if all commodities in the VAT system had been taxed. The country generated only ₦1.8 trillion, owing to generous tax incentives, granted by multiple state agencies in an ad-hoc fashion.

Nigeria’s total public debt stands at ₦44 trillion as of September 2022 and could rise to ₦77 trillion, after a loan-to-bond swap and new borrowings to fund the 2023 Budget.\

Much of the 2023 deficit financing is expected to be sourced locally as the prospect of external funding remains bleak due to tight conditions. Deficit financing from the domestic market could pressure market liquidity and higher bond and treasury bills yields, consequently increasing government borrowing costs.

The economy is grappling with foreign-currency shortage pressures. The country faces constrained oil production levels, leading to lower accretion to the FX reserves. Recently, the Central Bank of Nigeria has had to scale down its foreign exchange allocations to local companies, creating a material gap between the official and parallel-market exchanges in the country.

In addition, reports by Moody’s investors state that Nigerian banks have lent a significant amount of FX to the Central Bank, which poses additional risk, as there is an increasing possibility that the CBN will extend the life of some contracts, postponing repayment.

The three top contenders faced the same policy outlook, as their manifestos centred around the same core issues. However, they differed on timing and level of execution.

All three leading candidates were vocal about their resolve to remove the regressive fuel subsidies while also seeking to pursue some form of improvement in the current FX regime.

The presidential election winner will immediately be tasked with a course correction anchored on sound economic policy, fiscal and structural reforms, and monetary policy orthodoxy. The top policy priorities are clear, with fuel subsidy reforms and FX market liberalisation at the top of the agenda.

#NigeriaDecides: further food for thought

Inflation has soared above 20%, the highest figure since September 2005, despite hikes in interest rates, which were raised from 16.5% to 17.5% in January 2023.

The great influx of foreign capital that the stock market enjoyed before the oil price crash has reduced to a trickle because of difficulties in repatriating capital in bank shares and the perceived risks from changes in Central Bank policy.

Numerous faction movements and an unprecedented mass youth exodus among those exasperated by Nigeria’s worsening economic outlook gives that sinking feeling of impending doom.

A recent IMF report on the country quite accurately notes that “elevated inflation, and lingering external pressures, if left unaddressed, may exacerbate macroeconomic stability. This could impact growth, food security, social cohesion given extreme inequality and high poverty.

“The upcoming elections provide an opportunity for the new administration to advance structural reforms and offer a more prosperous future.”

Timely steer from cash?

As the two leading opposition parties challenge results on many fronts, there is a chaos wherever you turn.

The Central Bank of Nigeria’s replacement of higher-value notes has caused a steer. However, the CBN argues that the redesign will force people living in the country to bank their money, as more than 80% of money in circulation was held outside of the legal banking system.

The CBN said it would limit withdrawal amounts through ATMs to promote a cashless society and eradicate the physical risks of cash – robbery, laundering, terrorism. This trend towards digitising financial transactions is evident in the rapidly rising profiles of fintech companies such as Flutterwave and facilities such as AfriGo.

Was it coincidental timing that an eruption in cashless project activities came so close to the election? Did the reduction of larger-denominated currency in circulation stop rogue groups or affiliated factions from buying in to the outcome of the race for the presidency?

It is estimated that in rural areas, where there are often no bank branches or ATMs, 60% of Nigerians do not operate bank accounts. The independent view of people living in Nigeria was that fuel and cash scarcity disrupted payment for logistics, staff and the transportation of materials needed for polling.

The role of religion

Historically, in the sovereign region split between the Muslim north and the predominantly Christian south in Nigeria, there is an abstract memorandum of understanding for rotation of presidency between the two religions – the current president, Muhammadu Buhari, a Muslim northerner, succeeded Goodluck Jonathan, a southern Christian.

Tinubu, a southern Muslim, will be the first to put that arrangement in peril since M K O Abiola made an attempt in 1993. Yet it remains in doubt whether his campaign has galvanised northern voters sufficiently to support a southern Muslim.

On 25 February, nearly 84 million registered voters, representing 300 ethnic groups and cumulatively speaking more than 500 languages, moved to determine the future of Africa’s most populous nation and one of the world’s most culturally diverse countries. Hopefully, towards a more prosperous sovereign nation.

Special correspondent for Asaase News