The clients are demanding for compensatory damages, as well as consequential, exemplary and punitive damages in an amount to be determined at trial.

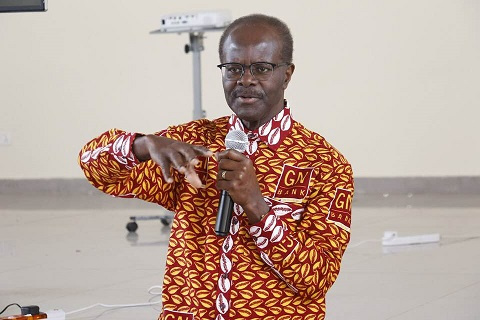

Two clients of the defunct GN Bank and the Gold Coast Fund Management have sued Dr Paa Kwesi Nduom in the United States of America for defrauding them.

The two clients say they are suing Nduom and some members of his family for shocking acts of statutory violations, money laundering, wire fraud, deceit and other related criminal acts.

According to the writ sighted by Asaase News, Birim Group, LLC, a California Limited Liability Company is the plaintiff in the matter acting as assignee for valuable consideration of all right, title, ownership, and interest in and to the claims of Mavis Amanpene Sekyere, an account holder of defendant Gold Coast Fund Management, and Nana Kwame Twum Barimah, an account holder of defendant GN Bank, Ghana.

Facts of the case

The introduction and summary part of the writ states that “this racketeering case arises from a series of shocking acts of statutory violations, money laundering, wire fraud, breach of contract, negligence, outright fraud, deceit and related criminal acts perpetrated by defendant Paa Kwesi Nduom, his family members and the several sham companies they operate.

“Plaintiff’s assignors, Mavis Amanpene Sekyere and Nana Kwame Twum Barimah) like many similarly situated depositors of defendants Gold Coast Fund Management and GN Bank, are victims of defendants’ fraudulent, avaricious and criminal conduct perpetrated on more than a million unsuspecting depositors who have lost their life savings because of defendants’ unlawful acts.

“Plaintiff alleges the Nduom family defendants, aided and abetted by each of the other defendants, engaged in a course of racketeering conduct predicated on illegal monetary transactions, money laundering, wire and mail fraud. Defendants were motivated by nothing more than greed and self-aggrandizement. They used the stolen money to fund eponymous vanity projects such as a sports Stadium, a University, a Foundation and a Soccer Club. Defendants’ actions not only cost depositors their life savings and untold hardship; they have contributed significantly to a serious on-going financial crisis in the Republic of Ghana.

“The Nduom family defendants, by and through their ownership, control and use of defendants GN Bank, Gold Coast Fund Management and over 60 undercapitalized interrelated companies, collected several million dollars of depositors’ savings, investment contributions and insurance premiums and, in violation of U.S. and Ghana laws, illegally laundered approximately US$63,000,000 (Sixty Three Million Dollars) of depositors’ funds through its Virginia-based sham “procurement and consulting service” company, International Business Solutions, LLC” the writ stated.

“Believing the U. S. to be a safe haven for the proceeds of their fraud, the criminal scheme involved, among other things, the transfer – through the instrumentality of the international money wire system – of inflated, over-invoiced and above-market rate fees disguised as payment for “management services” to defendant IBS.

“In fact, IBS is nothing but a shell company with an industrial zone store front office, no staff and a bare bones four-page website created solely to facilitate the Nduom defendants’ fraud. Plaintiff is informed and believes and alleges that all or a significant portion of the converted and illegally laundered depositor funds, including those assigned to plaintiff, were used for the personal benefit of the defendants to acquire assets, including the Illinois Service Federal Bank, which, consistent with the Nduom family’s self-aggrandizement, was promptly renamed Groupe Nduom Bank. In fact, defendants’ conduct, at once brazen, predatory, and wide-ranging in its effect on more than a million customers, is best described as Maddoff on steroids” the writ added.

As a consequence, the two former clients of Nduom’s companies claim that “these racketeering offenses, defendants GN-Bank and Gold Coast Fund Management, depleted all their customer deposits and have been unable to satisfy withdrawal demands by plaintiff’s assignors since late 2018 and continuing to the present.

“The total of these racketeering transfers amounted to US$63 million most of which have been used by the Nduom family and defendants to acquire U.S. assets, including defendant bank GN-IL, in violation of U.S. anti-money laundering criminal statutes”.

The case of Mavis Sekyere

Mavis Amanpene Sekyere contends that she entered into a written and oral agreement with defendant Gold Coast Fund Management whereby she “deposited her life savings in the approximate amount of US$80,000 into a segregated account as part of Gold Coast’s investor funds management portfolio. It was further agreed between assignor and Gold Coast that defendants would invest the funds prudently and conservatively in secure government and other low-risk investment instruments; and that any and all income, interest, accruals, profits and gains would be paid to her each quarter.

“Contrary to the agreement, assignor’s funds were commingled with other depositors’ funds and converted by defendants Gold Coast and each of them, to their own use and benefit. Defendants, in violation of the banking laws of Ghana, specifically Act 930, (Banks and Specialized Deposit-Taking Institutions Act) and the criminal statutes of the U.S., exchanged assignor’s deposits for dollars, pounds and euros, and through the instrumentality of the international wire system, wired the converted funds disguised as “management service fees” to defendant IBS. Defendants then used assignor and other depositor funds to acquire defendant GN-IL bank in Chicago, as well as acquiring other personal assets in the U.S”.

The case of Twum Barimah

It is also the case of Nana Kwame Twum Barimah, that he agreed to open an account with GN Bank’s Akim Oda branch.

“The segregated account was a depository for his earnings. The written agreement is currently in possession of defendants. The parties agreed that defendant GN-GH would maintain the funds on deposit, and upon request by check, branch teller or through defendants’ ATM network, assignor would withdraw funds from his account.

“Contrary to the agreement, defendants commingled assignor’s funds with other depositor funds and converted the funds to their own use and benefit. Defendants GN-GH and each of them, in violation of the banking laws of Ghana, specifically Act 930, (Banks and Specialized Deposit-Taking Institutions Act) and the criminal statutes of the U.S., exchanged the funds for dollars, pounds and euros and through the international wire system, wired the converted funds disguised as “management and service fees” to defendants’ related sham company, defendant IBS. Defendants also used assignor’s funds to purchase defendant GN-IL, a federally chartered bank in Chicago, as well as acquiring other personal assets in the U.S.

“In or about July 2019, defendant GN-GH breached the contract. Defendants GN-GH and each of them have refused and continue to refuse to provide assignor access to his funds of approximately US$30,000. Plaintiff’s assignor has appeared at defendants’ branches on numerous occasions since July 2019 to withdraw funds from his account. Notwithstanding his requests, defendants GN-GH and each of them have refused to return his funds.”

Reliefs sought

The plaintiffs in the suit are seeking a total of 11 reliefs. Among them are demand for compensatory damages, as well as consequential, exemplary and punitive damages in an amount to be determined at trial.

The plaintiffs are also praying for general damages according to proof and punitive and exemplary damages on account of defendants’ malice and oppression. For extraordinary equitable and or injunctive relief as permitted by law, equity, and statutory provisions sued hereunder, including attaching, impounding, imposing a constructive trust on, or otherwise restricting the proceeds of defendants’ illegal and criminal activities or their other assets so to assure plaintiff has an effective remedy.”

They also want the court to award “plaintiff restitution from defendants, and each of them, and ordering disgorgement of all profits, benefits, and other compensation obtained by defendants, including all ill-gotten gains from their illegal and criminal activities.”

Defendants in the suit

Paa Kwesi Nduom is the first defendant in the suit. Other defendants in the action are, GN Bank, an Illinois federally-chartered financial institution, International Business Solutions, LLC – a Virginia limited liability company, GROUPE NDUOM USA LLC – a Nevada company, GN USA LLC, a Nevada company, GN Money, LLC – a Nevada company; Groupe Nduom – a Ghanaian company, GN Bank, a Ghanaian company, Gold Coast Fund Management, a.k.a. Blackshield Capital Management – a Ghanaian company; Yvonne Nduom (Wife of Paa Kwesi Nduom), Nana Kweku Nduom, Edjah Nduom, Nana Aba Nduom, Robert Klamp, James L. Others are Buckner, Lisa Finch, Francis Baffuor, William C. Goodall, and Donald Davidson.

Source:AsaaseRadio